Inspect Insurance Policies To Reduce Damages

Collectibles and Other Personal Treasures May Not Be Adequately Covered. Check now, before it is too late.

CHERRY HILL, N.J. - Major flooding, hurricanes, tornados, and tropical storms offer a not-so-subtle reminder that homeowners should take precautions to protect their homes from natural disasters. American Collectors Insurance, a national provider of collector vehicle and collectibles insurance, offers advice for reviewing homeowner's and other insurance policies. According to the agency, now is the time to make certain that your home and its possessions, including collectibles, are adequately covered.

"While natural disasters can lead to devastating losses, often times it leads to more awareness about the types of insurance people have. By making sure their homes and possessions are adequately insured, people can sleep easier, knowing that they will be properly compensated in the event of a loss," says Laura Bergan, the Director of Marketing for American Collectors Insurance. According to Bergan, homeowner's and other insurance policies should be reviewed annually, and now is an ideal time to do so. She also encourages consumers to look into whether their collectible items are included in that coverage. Many times the answer is no.

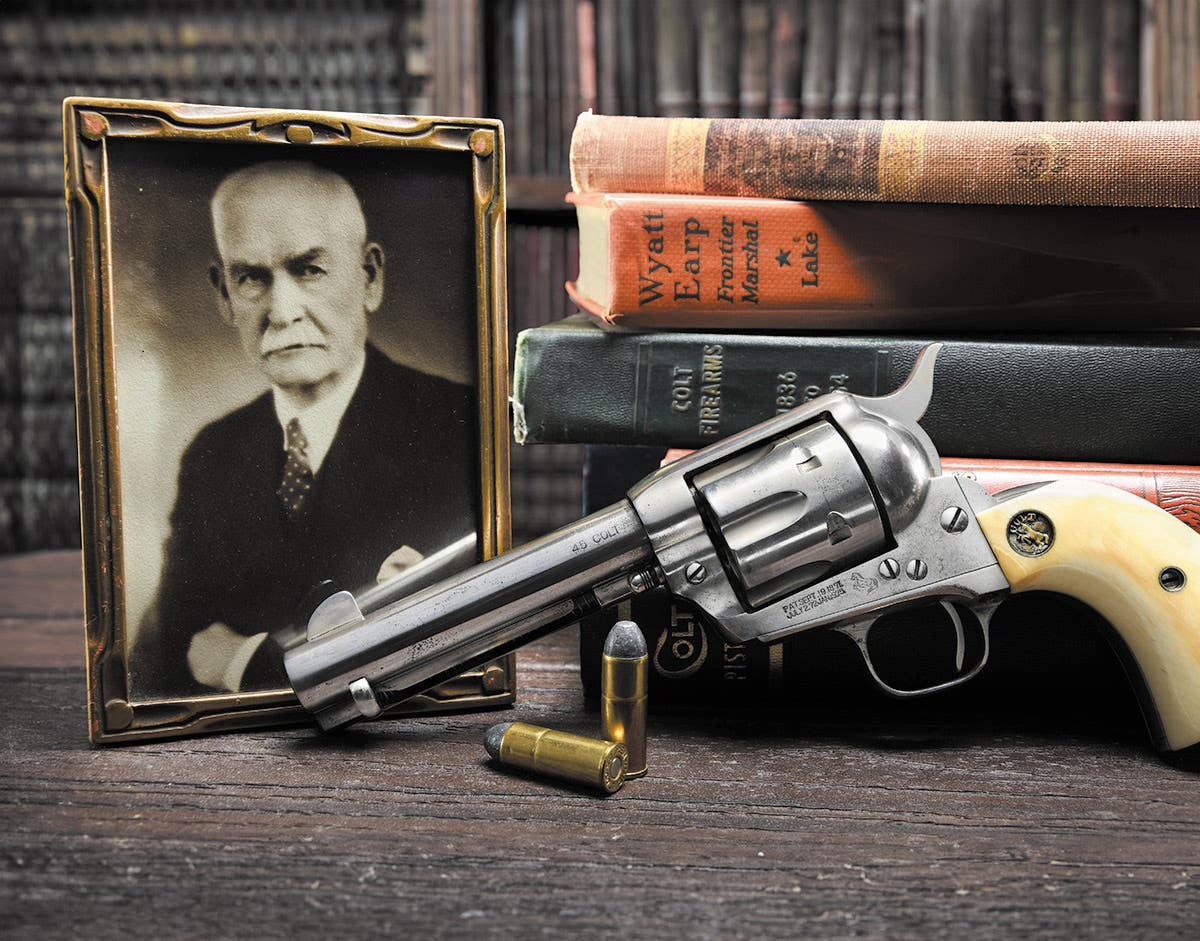

"Unfortunately, collectibles are typically not adequately covered by insurance agencies," says Bergan. "People put a lot of time and money into their hobbies, especially collections. Whether people collect trains, dolls, crystal or something a little more unique, their collections are likely worth a lot more money than they think. Regrettably, collectors often don't find out that their collections were underinsured, or not insured at all, until after the damage has occurred. Having a conversation with your agent is definitely advisable to determine if your family's collections are properly insured."

Specialty insurance for collectibles offers peace of mind for collectors who have spent years and significant money amassing their valued collections. Specialty policies have broad coverage that includes protection against perils such as earthquake, accidental breakage and flood, which are typically not covered by homeowners insurance. Collectors may be surprised to learn that collections valued up to $10,000 can be insured for as little as $75 annually in most states. In addition to providing specialized insurance, American Collectors Insurance has the following recommendations for protecting collections from damage during flooding, high winds, or storms:

- If you don't display your collection, store it in the attic or a dry area of your home. Water damage is harmful to almost any collection, so keep yours protected from floods and leaks.

- If you must store your collection in the basement, use plastic, waterproof containers. They protect collectibles against water damage better than cardboard boxes.

- Keep a list of your collection in a safe place -- such as a locked, fire-proof box -- with your insurance documents. This is true of all important documents. If you have to make a claim, everything you need to do so will be safe in one place.

"During a natural disaster the last thing on anyone's mind should be his or her possessions," says Bergan. "Your only worry should be keeping yourself and your family safe from harm's way. If you've taken these recommended precautions to protect your possessions, you can do just that."